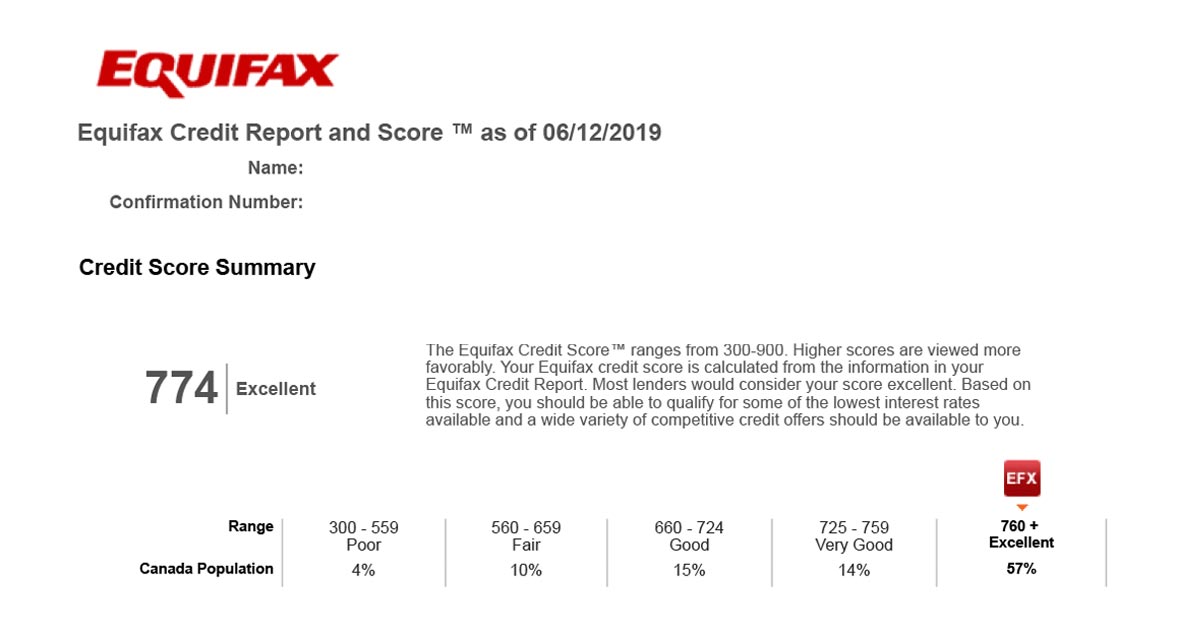

Sometimes referred to as a credit utilization ratio, many credit scoring models take into account how high your balance is compared to your total available credit limit. This includes how many accounts you have open as well as all the positive and negative information about these accounts.įor example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent. How you manage your payments is one important factor used during the calculation of your credit scores. If you’re interested in building your credit, understanding what these factors are can help you create a plan to build healthy credit habits. There are five main factors that can affect the calculation of credit scores. Factors That Can Affect The Calculation Of Your Credit Scores Lenders that check credit will be happy to see that you have a high credit score, but ultimately loan approval depends on a variety of factors. Is 800 A Good Credit Score?Ĭredit scores above 759 are considered excellent. In fact, with a credit score of 750, you’re only 10 points away from excellent as credit scores that fall between 760 and 900 are considered excellent. Is 750 A Good Credit Score?Ī credit score of 750 is considered very good (scores between 725 – 759). While certain lenders may consider your credit score to be risky, keep in mind that credit scores are not the only deciding factor when it comes to loan and credit approval. If you have a 620 credit score, it usually means you have fair credit. With a 600 credit score, you may be able to qualify for a loan with a bank, however, you probably won’t get the most competitive rate.īorrowers with a 600 credit score may have better luck qualifying for a loan with alternative lenders whose lending criteria are much more lax than banks. In general, a 600 credit score falls under the “fair” credit score range. Additionally, your Equifax credit scores might be different from your TransUnion scores. Furthermore, the credit scores a lender sees are different from those that you might have access to. This means that what one lender considers to be a “good” credit score will not be the same for another lender.

Of course, there are many different types of credit scores and scoring models. Good credit scores in Canada are usually 660 or higher. That being said, if you’re interested in knowing what your credit scores mean, here are some general guidelines that can help. It all depends on what scoring model that specific lender uses and how they use it during their approval process. One lender may consider credit scores of 760 to be excellent, while another may consider scores above 780 to be excellent. You can also pay Equifax or TransUnion to see your real score, range, and report.Ĭanadian Credit Scores And What They MeanĪs we mentioned above, there is no definitive model for what certain credit scores mean to all lenders and creditors. You can use Compare Hub, which has the Equifax score and report. It means that you should get as close to the Equifax or TransUnion scores as you can. That doesn’t mean that all third-part companies are misleading you.

That means your credit range can shift depending on where you look. However, they can calculate your score using their own methods.

CREDIT SCORE RANGE EQUIFAX FOR FREE

Of course, you can check your score for free from a lot of third-parties. Each has its own approach to determining scores. There are two different credit reporting bureaus in Canada, Equifax and Transunion.

Your Credit Score Range is Determined By Two Companies You are the only one who can improve your credit scores, this makes understanding your credit that much more important. Generally, a credit company or lender will look at both your credit score and your credit report, as well as a variety of other factors (employment status, income, debt levels etc.) to determine your creditworthiness. Depending on your scores and ranking, you may receive lower interest rates and may be more likely to be approved for loans and other credit products. Knowing where your credit falls on the credit score range is important.

0 kommentar(er)

0 kommentar(er)